Epoch Master Global Business(Jiangsu)Inc.

Address:Rm.3-93,Tengfei building,No.88 jiangmiao rd., research and innovation park,

Nanjing zone,(jiangsu) pilot free trade zone,China

Tel:13770711448 Email:sales01@epoch-master.com

In recent months, the market of float and photovoltaic glass has been depressed, and the original price has entered the loss stage. However, the production line of photovoltaic glass has increased significantly since July, and the production capacity of float glass has been limited. The reason is that the profit level of photovoltaic glass remains low in recent years, the current inventory days is high, the pace of new photovoltaic glass production capacity is slowing down, and there is centralized cold repair. And the float glass enterprise capital is generally strong, in July initially into a large range of losses, the current production line production intention is temporarily limited. In the future, due to the further expansion of supply and demand difference and obvious profit compression, the float and photovoltaic glass production capacity is still expected to further decline, the difference between supply and demand of raw material soda ash is expected to expand, and the profit will show a shrinking trend.

Float glass: the industry initial losses, production capacity temporarily maintain high

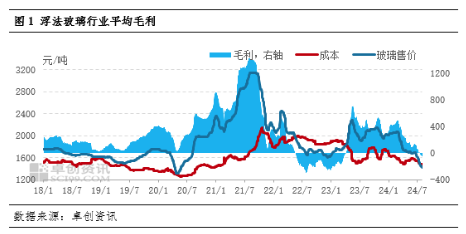

Since this year, the float glass demand end terminal engineering project orders have shrunk significantly, the orders of processing plants are insufficient, and the demand has declined significantly. In the second half of the year, the peak season failed to cash as scheduled, and the downstream orders improved in July was insufficient, basically flat in June, and some were still reduced. Superlay processing plant collection difficulty and profit of finished products are weak, the middle and downstream positions are more cautious, continued just need to replenishment. The production and sales rate of the float factory is low, the inventory is increasing rapidly, etc. Under the factors of not as expected, the price of the float glass falls rapidly, and the industry gradually enters the loss. By the end of July, the average gross profit of the whole industry was-48.02 yuan / ton, with a small loss.

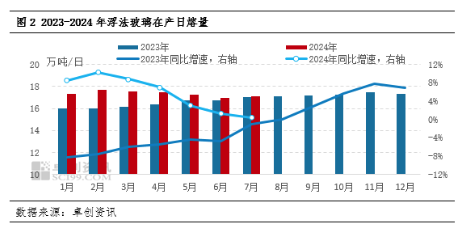

Although the float glass industry into the loss, the industry inventory days also reached the average high level of more than 30 days. However, based on the initial loss, the gross profit in the industry region is still different, some of which are still near the break-even line, while the old line in the obvious loss areas is relatively small, so there is no centralized cold repair or production suspension in the industry. By the end of July, there were a total of 296 float glass production lines (excluding some indicators have been replaced production lines), 250 in production, with a total daily melting capacity of 170,865 tons, 1,300 tons more than last month (169,565 tons), 0.42% more than the same period last year. Within a month, 1 new production line was ignited, 1 resumed production, 1 cold repair, and 8 lines were production, of which 5 were changed from color glass or steam glass. It can be seen that the shipments of all varieties are relatively weak. Due to the high inventory of automobile glass, the sales pressure of automobile glass increases, and the inventory is also rising.

Later stage, the current industry inventory is at a high level, profits or will be further reduced. The number of stock projects on the demand side continues to reduce expectations, the future production line cold repair or production suspension is expected to strengthen, short month cold repair enterprises is still cautious. There is expected to be 4-5 lines of cold repair in August. Combined with the current production kiln age and the expectation of cold repair production, it is expected that there will be cold repair in advance and the increase of external production lines from September. It is expected that the daily production capacity will fall to around 160,000 tons by the end of 2024. But from the current industry supply and demand structure, or it is still difficult to achieve the reversal of the supply and demand structure, in the next few months the industry inventory will remain at a high level, or will have a further increase, the price will still form a suppression.

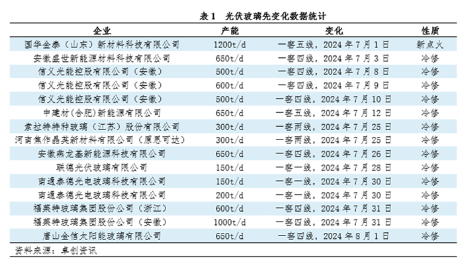

The growth rate of photovoltaic glass production capacity slowed down significantly, and the cold repair was relatively concentrated

Recently, the domestic terminal power station project is not as expected, and the follow-up volume of overseas orders is limited. In July, component manufacturers maintained low production, part of the finished product inventory. Under the lower profit level, most manufacturers purchase on demand, the willingness to prepare goods is generally not high, and continue to reduce the price psychology. Within the month, the orders of glass manufacturers were not saturated, and the inventory showed a continuous increasing trend. Part of the inventory pressure is obvious, the transaction of negotiation space. Monthly 2.0mm coated glass mainstream price is 14-14.5 yuan / square meter, 3.2mm coated glass price is about 23.5 yuan / square meter. Although the price of soda ash is loose and the production cost drops slightly, the price of finished products is also low, the profit margin of manufacturers is compressed obviously, and some losses are slightly lost. In this context, the cold repair of the device increased, and the production pace of some new production lines slowed down. According to the statistics of Zhuochuang Information, by the end of July, there are 61 ultra-white calendering glass production bases, 122 kilns and 524 production lines, and the daily melting capacity is 109,650 tons / day, down 4.04%; an increase of 20.85%. Within the month, there is a new ignition kiln with a daily melting capacity of 1200 tons and 13 cold repair production lines, with a total daily melting capacity of 6250 tons / day, accounting for 5.70% of the total production capacity. In August, the price of photovoltaic glass was reduced by 0.5 yuan / square meter compared with July, the module started slightly increased, and the market is still in the stage of oversupply. At the beginning of the month, Tangshan Jinxin first kiln four line 650 tons / daily line cold repair, some devices have cold repair plan, no new production line ignition, the late supply shows a continuous downward trend.

In the later market, although the terminal installation volume shows an increasing trend, but the growth rate is less than expected. At the same time, the inventory of finished products of component manufacturers is high, part of the early inventory, and the operating rate is difficult to be significantly improved. Although the growth rate of photovoltaic glass production capacity is slowing down, and some devices are cold-repaired, most of the production capacity is stable, and the inventory pressure of most manufacturers continues to increase. On the whole, the supply is relatively sufficient. Overall, the gap between supply and demand is expected to further expand, and some prices still have room to fall. With the compression of the profit space of manufacturers, some or only retain the processing link, the old production capacity has been withdrawn, and the pressure on the supply side may be relieved.

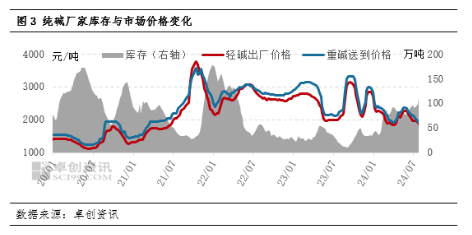

Glass production capacity is expected to shrink, soda soda supply pressure increases

In the second half of 2023, the soda ash industry will enter a wave of expansion. In 2024, more than 2 million tons of new capacity will be released, and the supply pressure will gradually increase. In July, the soda ash manufacturers reduced and maintained limited maintenance equipment, and the starting load of the industry maintained a high level. However, the production capacity of heavy downstream photovoltaic glass and float glass has decreased, the light part of the downstream cost pressure remains, the overall demand performance is weak, the soda ash manufacturers' new single follow-up is insufficient, and the overall inventory continues to increase.

In July, the focus of gravity of domestic soda ash spot price continued to decline, and the cumulative decline was 100-200 yuan / ton in the month, and the profitability of the industry weakened accordingly. Taking the east China joint manufacturers as an example, the profit space dropped to about 100 yuan / ton. In August, the soda ash devices such as Tianjin Factory, Hebang No.1 Factory and Jiangxi Jinghao kept maintenance plans, and the starting load trough may appear in the middle of the month. However, there is a marginal weakness in heavy downstream demand. Mid-late 4-5 float glass production lines are expected to be cold repaired, and some photovoltaic glass devices may also be cold repaired. Market expectations are bearish, and downstream procurement enthusiasm is poor. Although some soda ash manufacturers have some intention to stabilize prices, under the background of increasing supply pressure of soda ash industry, the soda ash market in August may still have room to decline, and profitability may further decline.(Zhuochuang Information)