Epoch Master Global Business(Jiangsu)Inc.

Address:Rm.3-93,Tengfei building,No.88 jiangmiao rd., research and innovation park,

Nanjing zone,(jiangsu) pilot free trade zone,China

Tel:13770711448 Email:sales01@epoch-master.com

Abstract

4, the middle of the price of glass will continue to be suppressed by the weak demand is difficult to rise, although the profit loss forced supply reduction may not be ignored, but before the large-scale cold repair, glass is still dominated by air.

1 Demand is weak, and real estate continues to drag it down

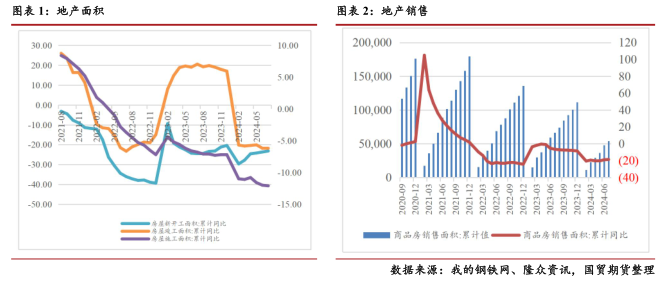

Demand continues to be weak, and it will take time for the real estate to stabilize and recover. Recently, the real estate data released by the Bureau of Statistics, from January to July, the construction area of real estate development enterprises was 703286 million square meters, down 12.1% year on year. The area of new housing construction was 437.33 million square meters, down 23.2 percent. The completed housing area was 300.17 million square meters, down 21.8 percent. The real estate policy is difficult to reverse the downward demand in the short term, and the middle and back-end data of the construction area and the completed area continue to decline significantly. According to the new construction data a year and a half ago, it can be predicted that the subsequent weak glass demand is still the main driver to restrain theprice.

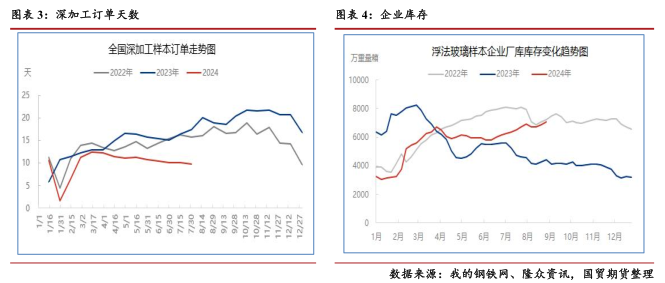

In addition, the performance of the order days of the sample of deep processing enterprises is also weak this year. First of all, the order days are significantly lower than those in previous years. The recent order days of deep processing enterprises are 9.8 days, -51.24% year on year. According to the law of previous years, the order days held by deep processing sample enterprises in the second half of the year are significantly better than that in the first half of the year, and this year, subject to the real estate market, the seasonal positive effect of float glass demand has subsided. Although the traditional peak season is approaching, but the processing plant to undertake orders is not optimistic.

Plat glass demand contraction concerns, has obviously on the market enthusiasm, the middle and lower reaches of the goods is very cautious, just need to give priority to, lead to float glass enterprise shipment tepid, inventory pressure, and significantly more than the same period last year, the sample enterprise total inventory 70.544 million heavy box, from + 1.88 million heavy box, + 59.31%. The average daily production and sales ratio is weak, and the industry continues to accumulate the inventory state. Under this pressure, the float glass original prices have fallen.

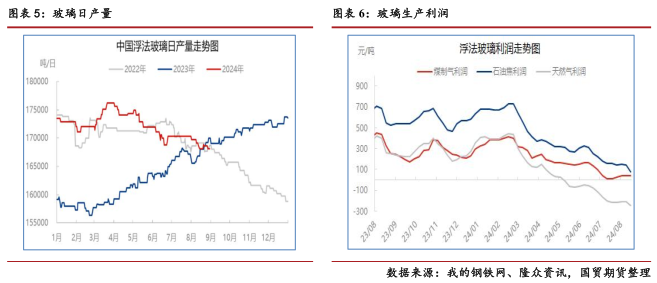

Recently, the high reduction of glass production, although due to the large squeeze of production profit, some production lines water cold repair, and the new capacity delayed, supply gradually reduced, but the production is rigid, due to the cold repair cost and other factors, it is difficult to have a large supply reduction in the short term, the supply will still be high, the imbalance between supply and demand is prominent.

In August, one production line was fired and seven production lines were released into water, reducing supply. In addition, some production lines changed from white glass to super white or colored glass, and the overall supply of white glass declined. Although the high output decline, but the reduction is still insufficient, last week the national float glass daily melting volume of 168,100 tons, compared with 22-0.3%. The operating rate was 81.06%, compared with 22-0.33%; the capacity utilization rate was 83.08%, compared to 22-0.25%. This week, 1 production line water cold repair, weekly supply slightly down month. In September, there are not many cold repair plans in the production line, and there are still some production lines with ignition drawings, and the ignition production line in August is about to produce glass.

The mismatch between supply and demand continues, and the price continues to fall. As the price breaks through part of the cost line, the production profit of glass factories will continue to squeeze, forcing the industry to clear, and the contradiction between loose supply and demand in the medium term may be solved through supply contraction.

The mismatch between supply and demand continues, and the price continues to fall. As the price breaks through part of the cost line, the production profit of glass factories will continue to squeeze, forcing the industry to clear, and the contradiction between loose supply and demand in the medium term may be solved through supply contraction.

The production profit of glass factory is mainly under pressure, and the weekly average profit of float glass with natural gas is-247.76 yuan / ton, down 36.65 yuan / ton from the previous month; the weekly average profit of float glass with coal to gas is 39.79 yuan / ton, down 3.65 yuan / ton; the weekly average profit of float glass with petroleum coke is 80.81 yuan / ton, down 61.65 yuan / ton.

However, attention should be paid to the sustainability of the profit-forced supply reduction. In the industry, the number of elderly production lines is still large, 9-12 years belong to the elderly kiln stage, 13 years and above belong to the super old kiln. At present, the production capacity of advanced kilns accounts for more than 25%, and there are also about 3% of ultra-high kiln age kilns.

3 Review

Since this year, due to the rigid supply of glass, continued high production and demand by real estate drag, constantly weak, the imbalance between supply and demand is obvious, the inventory is rising, the industry pessimism is heavy, the price focus continues to fall. At present, although the profit of part of the glass factory has lost money, but due to the cost and other factors, it is difficult to have a large supply reduction in the short term, the price will continue to be under pressure.

September contract to futures sharply down into the delivery month, can see the weakness of spot. The problem of demand can only be solved through supply, the price of glass in the middle will continue to be suppressed by the weak demand to the difficult to rise, although the loss of supply reduction may not be ignored, but before the large-scale cold repair, glass is still dominated by air.

Strategy advice: meet the high altitude match.

Risk concerns: real estate data, production and maintenance, etc.(International Trade Futures)