Epoch Master Global Business(Jiangsu)Inc.

Address:Rm.3-93,Tengfei building,No.88 jiangmiao rd., research and innovation park,

Nanjing zone,(jiangsu) pilot free trade zone,China

Tel:13770711448 Email:sales01@epoch-master.com

This week, the domestic soda ash market fluctuated, and transactions at the end of the month were tepid. According to Longzhong Information data monitoring, the overall operating rate during the week was 89.41%, an increase of 0.19% from the previous month. The output of soda ash was 734,000 tons, an increase of 0.22%. The fluctuations in the equipment were small, and the operation was relatively stable. The inventory of soda ash manufacturers during the week was 833,600 tons, an increase of 9700 tons, or 1.18%, from Monday. The price at the end of the month has not been determined, market transactions are weak, and inventories have increased in a narrow range. Some companies have high inventories, but most companies have low inventories. It is understood that social inventory is basically stable during the week, with small fluctuations; during the week, 35% of the soda ash inventory of downstream glass companies has been on the market for 17+ days, an increase of 1+ days, and on-site + pending for 22+ days, an increase of 2+ days; 45 % of the samples are 16+ days old, with an increase of 1+ days, and on the market + pending for 20+ days, with an increase of 1+ days; 50% of the samples are 15+ days old, with an increase of 1+ days, on the market + pending for 20+ days, with an increase of 1 + days, imports have arrived at the port, individual companies' inventories have increased, and most companies have little fluctuation. On the supply side, the load of maintenance and other individual enterprises in Kunshan, Jiangsu is abnormal. It is expected that the overall operation and output will decline next week. It is estimated that 88+% of the operation will be started next week and the output will be 720,000 tons. Towards the end of the month, corporate prices are announced one after another, and during the new order negotiation and order receiving stages, shipments slow down. Entering April, companies such as Red Sifang and Junhua have maintenance plans, and individual companies have maintenance expectations, but the specific impact is uncertain. On the demand side, downstream demand is stable, procurement is mainly based on demand, and overall consumption is normal. Near the end of the month, there is a replenishment plan in the downstream. Some companies have imported alkali arriving at the port, and the inventory has increased. Due to the impact of soda ash maintenance in the future, some companies have increased their inventories appropriately. During the week, the daily melting capacity of float method was 176,500 tons, which was stable month-on-month, and that of photovoltaic was 100,600 tons, which was stable month-on-month. Photovoltaic production lines are expected to be launched in the near future, with 3-4 lines expected to have a production capacity of 4,000-5,000 tons. To sum up, in the short term, the trend of soda ash will fluctuate and the supply and demand game will continue.

In terms of resource supply:

The overall operating rate of soda ash this week was 89.41%, which was 89.22% last week, a month-on-month increase of 0.19 percentage points. Among them, the operating rate of ammonia and alkali was 85.46%, an increase of 2.02 percentage points month-on-month, and the operating rate of co-production was 89.33%, -1.94 percentage points month-on-month. The overall operating rate of 14 enterprises with an annual production capacity of one million tons or above was 89.09%, -1.10 percentage points month-on-month.

Demand side:

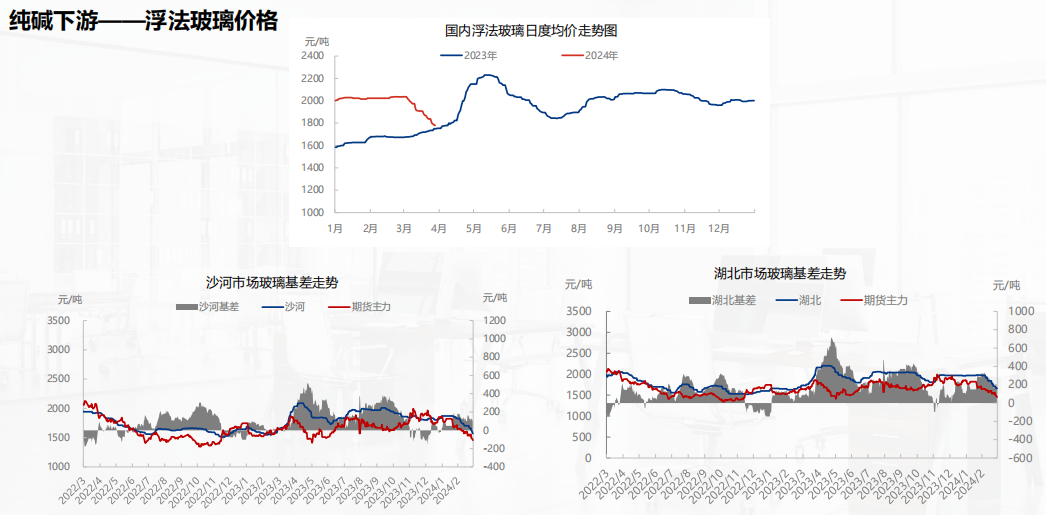

This week, the overall shipments in the North China market have slowed down significantly compared with last week. Inventories have increased. Enterprise prices have been reduced several times. Some manufacturers have canceled their value-preserving policies and implemented rebate discounts. Business owners have lacked confidence and are cautious in purchasing.

The float glass market price in East China has declined. Most companies have traded price for volume, but a small number of companies have limited price concessions due to cost pressure, resulting in poor shipments.

The float glass market price in central China has declined. In order to reduce inventory pressure, companies have offered profit-making shipments, which has stimulated a periodic improvement in production and sales. The inventory barrier has slowed down from last week.

Float glass prices in South China fell. The performance of deep processing is average. In order to stimulate downstream purchases, manufacturers continue to introduce profit concessions, but the effect of volume exchange is average, and the industry maintains accumulated inventory.

The price of float glass in the southwest region fell back. The local float glass production increased, and the demand was not obviously beneficial. The imbalance between supply and demand drove the price down.

The Northeast market as a whole is operating weakly. Amid weak demand, prices have also dropped several times. Some manufacturers mainly source goods from abroad, and downstream procurement is cautious.

Demand in the northwest market is not good, market sentiment is weak, manufacturers' shipments have slowed down significantly, prices have also loosened, downstream procurement is cautious, and most companies have increased inventories.

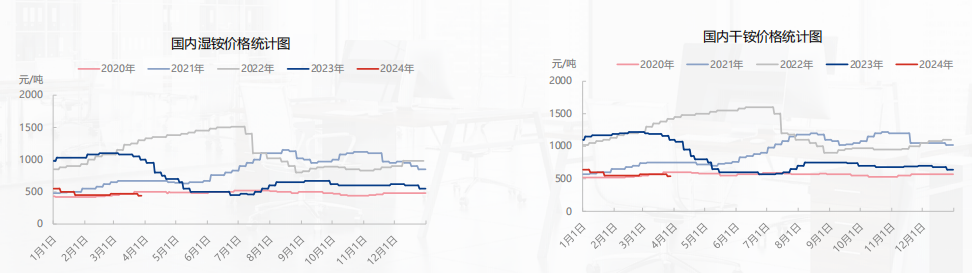

Soda ash by-product - ammonium chloride market

This week, the domestic ammonium chloride market price has seen a slight correction, with the range ranging from 20-30 yuan/ton. The current mainstream ex-factory price of dry ammonium is 510-550 yuan/ton, and the mainstream ex-factory price of wet ammonium is 400-450 yuan/ton. tons, the actual transaction price is subject to negotiation alone. Recently, the downstream compound fertilizer factories have not been active in purchasing raw materials due to the high pressure on finished product inventory. Therefore, the recent signing of new orders by ammonium chloride manufacturers has been relatively slow, and the order receiving situation has been somewhat average. At present, some joint alkali companies have entered a comprehensive overhaul, and some factories have not yet reached full operation. The overall operating rate across the country has dropped slightly compared with the previous period. In the short term, the ammonium chloride market trend is weak, and there are more transactions per transaction.

Soda ash - a hot topic in the market at present

1. Market influencing factors:

1) Soda ash plant operating status and maintenance expectations;

2) The operation status and recovery time of the northwest enterprise's equipment;

3) The number of soda ash orders waiting to be shipped has decreased and is close to 8 days;

4) Soda ash import and export status.

2. Supply side:

The load of maintenance and other individual enterprises in Kunshan, Jiangsu is abnormal. It is expected that the overall operation and output will decline next week. It is estimated that 88+% of operations will be started next week and the output will be 720,000 tons. Towards the end of the month, corporate prices are announced one after another, and during the new order negotiation and order receiving stages, shipments slow down. Entering April, companies such as Red Sifang and Junhua have maintenance plans, and individual companies have maintenance expectations, but the specific impact is uncertain.

3. Downstream demand:

Downstream demand is stable, procurement is mainly based on demand, and overall consumption is normal. Towards the end of the month, there is a replenishment plan in the downstream. Some companies have imported alkali arriving at the port, and the inventory has increased. Due to the impact of soda ash maintenance in the future, some companies have increased their inventories appropriately. During the week, the daily melting capacity of float method was 176,500 tons, which was stable month-on-month, and that of photovoltaic was 100,600 tons, which was stable month-on-month. Photovoltaic production lines are expected to be launched in the near future, with 3-4 lines expected to have a production capacity of 4,000-5,000 tons.

4. Soda ash spot price trend:

Taken together: the short-term soda ash trend fluctuates and the supply and demand game plays out.