Epoch Master Global Business(Jiangsu)Inc.

Address:Rm.3-93,Tengfei building,No.88 jiangmiao rd., research and innovation park,

Nanjing zone,(jiangsu) pilot free trade zone,China

Tel:13770711448 Email:sales01@epoch-master.com

1、Weekly review of float glass market

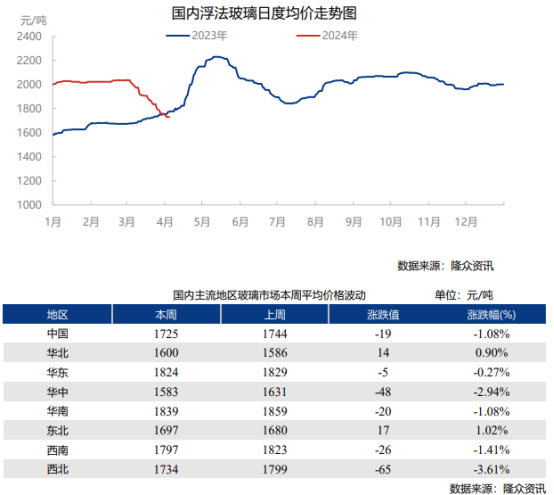

As of April 11, 2024, the national average float glass price was 1,733, an increase of 3 from the price on the 4th; this week, the national weekly average price was 1,725, a decrease of 19 from last week (1,744). (Unit: Yuan/ton)

This week, the focus of domestic float glass spot market transactions declined but the magnitude slowed down. The release of production lines combined with the overall low price of raw film companies. Stimulated by the increase in most companies, the mid-stream and downstream companies appropriately replenished their inventories, and corporate inventories fell. However, with the end of this round of replenishment in some regions, market transactions have slowed down.

Detailed market description of each district:

In the North China market, with the price of original films at a low level, the middle and lower reaches have replenished their inventories, which has driven the production and sales ratio of production companies to maintain a high level, and inventory has been significantly reduced. Under this support, prices have also risen many times. As the weekend approaches, with downstream stocking basically completed, the market atmosphere in Shahe has weakened.

Prices in the East China market have been stable and rising this week. Some raw film companies have increased their prices, boosting market confidence. The mood of mid- and downstream companies in purchasing goods has improved compared with before the holiday, and some companies have reduced inventories. Prices in the Central China market first fell and then rose this week, and the market was in a good mood to purchase goods. The local midstream and downstream companies purchased appropriate amounts of goods and shipped them overseas. The average daily production and sales of many factories continued to exceed 100, and raw film companies significantly destocked.

Market prices in the South China region first fell and then rose. Stimulated by the increase, downstream stocking enthusiasm was high, and corporate inventories dropped significantly.

A 900 tons/day production line in the southwest market was released. With the output reduced, companies increased their prices, which drove downstream replenishment and corporate inventories fell.

The overall shipments of manufacturing companies in the Northeast region are good, and downstream stocking supports manufacturers' inventory reduction, and prices have also increased.

In the northwest region, driven by external market sentiment, the downstream stockings are appropriate, and manufacturers' shipments have also improved compared with the previous period. However, different manufacturers have different price adjustments depending on the situation.

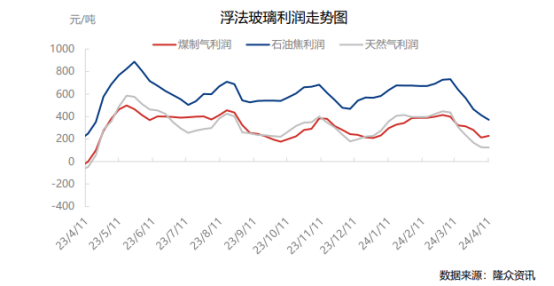

2、Float glass cost and profit analysis

This week (20240405-20240411), the average weekly profit of float glass was 241 yuan/ton, a week-on-week decrease of 10 yuan/ton. Among them, the average weekly profit of float glass using natural gas as fuel is 125 yuan/ton, a decrease of 3 yuan/ton from last week; the average weekly profit of float glass using coal gas as fuel is 228 yuan/ton, an increase of 16 yuan / ton from last week; the average weekly profit of float glass using petroleum coke is 371 yuan / ton, a decrease of 41 yuan / ton from last week.

3、Changes in float glass supply and demand

3.1 Supply situation analysis

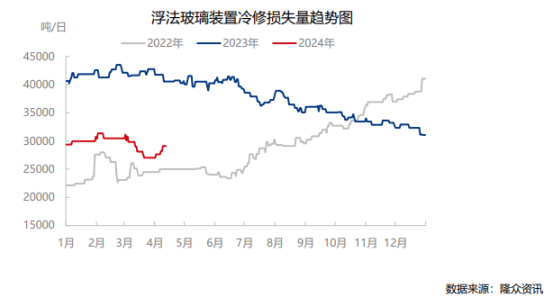

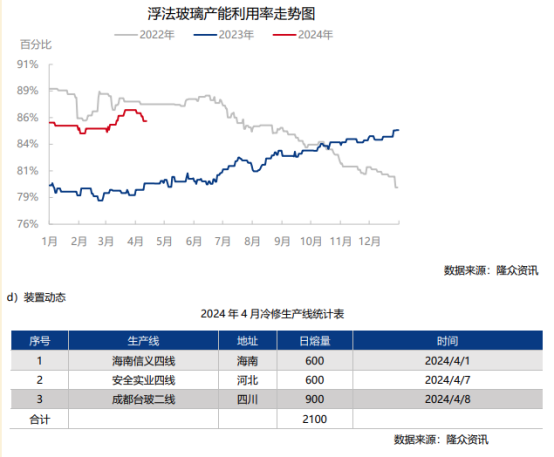

After excluding zombie production lines, there are a total of 304 domestic glass production lines (203,500 tons/day), of which 256 are in production and 48 are suspended for cold maintenance.

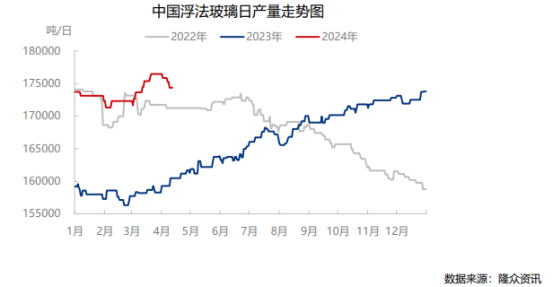

Daily output analysis

As of April 11, 2024, the national float glass daily output was 174,400 tons, -0.85% compared with the 4th. This week (20240405-0411), the national float glass output was 1.2238 million tons, -0.73% month-on-month and +9.29% year-on-year.

b) Loss analysis

As of April 11, 2024, the cold repair loss of domestic float glass companies was 29,130 tons/day, +5.43% month-on-month. This week (20240405-20240411), the national float glass loss was 200,600 tons, +4.70% month-on-month.

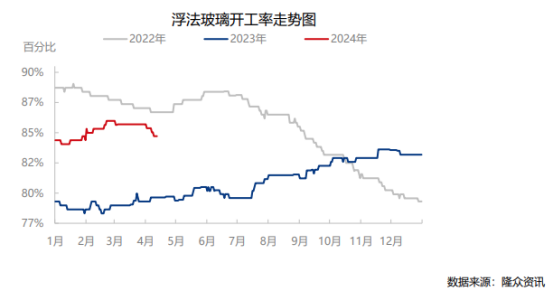

c) Operation/utilization analysis

As of April 11, 2024, the operating rate of the float glass industry was 84.21%, -0.66% compared with the 4th; the capacity utilization rate of the float glass industry was 85.68%, -0.74% compared with the 4th. This week (20240405-0411) the average operating rate of the float glass industry was 84.4%, -0.61% month-on-month; the average capacity utilization rate of the float glass industry was 85.92%, -0.63% month-on-month.

3.2 Demand situation analysis

The order-taking performance of processing enterprises in North China is still relatively average. Driven by the market atmosphere, they mainly prepare appropriate amounts of inventory to replenish their inventory. As a certain amount of inventory has been reserved, the purchasing pace has slowed down.

In the East China market, most orders from deep-processing companies have not improved significantly this week. They are mainly stocking up on raw films and are generally confident about the market outlook.

The performance of deep processing in the Central China market this week is still average. Affected by market sentiment, the midstream and downstream sectors are stocking up appropriately and buying at low prices.

Although the orders of downstream deep processing enterprises in the South China market have not improved significantly, affected by the price increase atmosphere, downstream replenishment is appropriate.

The overall orders for deep processing enterprises in the southwest market are average, and driven by the overall atmosphere, some downstream companies choose opportunities to replenish goods.

The overall demand performance in the Northeast and Northwest regions is average. Driven by the surrounding market atmosphere, stocking and replenishment are the main focus.

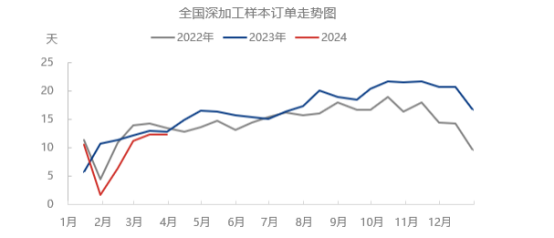

As of March 29, 2024, the order days for deep processing enterprises were 12.3 days, -0.6% month-on-month and -4% year-on-year. The performance of engineering deep-processing orders is average, mostly maintained at around 7-10. Some companies are still executing pre-holiday orders. New orders are currently being issued slowly. The market is paying attention to the placement of engineering orders in mid-April or early May; home decoration orders are relatively good. Export orders have the best performance. According to the glass deep processing industry surveyed by Longzhong, most of the export orders currently held can be scheduled until mid-April and the end of April, and a few can be maintained until May.

4、Float glass inventory analysis

5、Analysis of float glass related products

As of April 11, 2024, the total inventory of float glass sample companies nationwide was 60.374 million heavy boxes, which was -4.818 million heavy boxes month-on-month, -7.39% month-on-month, and +3.13% year-on-year. The number of discounted inventory days was 24.8 days, -1.7 days compared with the previous issue; stimulated by the increase of some companies, the price of superimposed original films has reached the psychological expectations of some industry players. This week, the mood for purchasing goods is good in many places, with average daily production and sales exceeding 100 consecutively. Overall, the original film companies Inventory is in destocking status.

6、Float glass later market forecast

a) This week, the trend of domestic soda ash is stable to strong, some companies have closed orders, some companies have raised prices, and sentiment has been boosted. According to Longzhong Information data monitoring, soda ash output during the week was 706,200 tons, an increase of 8,000 tons month-on-month, or 1.15%. The overall operating rate of soda ash was 84.71%, which was 85.05% last week, a month-on-month decrease of 0.34%. The load of individual enterprises has increased, production capacity has been adjusted, and enterprise equipment has been reduced and shut down, so the overall supply has been limited. The inventory of soda ash manufacturers is 912,500 tons, a month-on-month decrease of 4,300 tons, or 0.47%. The order waiting list for soda ash companies has increased to 14 days, the company is receiving better new orders, and the transactions are improving. It is understood that social inventories are increasing in a narrow range with small fluctuations. On the supply side, the soda ash reduction equipment may face recovery next week. Only some equipment is expected to be overhauled. The overall supply is increasing. The operating rate is expected to be around 88% next week, with an output of 730,000 tons. The spot price fluctuated slightly, with transaction orders being the main focus. On the demand side, downstream demand performance improved, and inquiries and transactions increased. The downstream start-up fluctuated slightly. During the week, the daily melting volume of float method was 174,400 tons, a decrease of 0.85% from the previous month. The daily melting volume of photovoltaic was 106,200 tons, which was the same as the previous month. The float and photovoltaic production lines are expected to be stable next week, and two photovoltaic production lines are scheduled to be ignited near the weekend, totaling 2,100 tons. To sum up, the short-term soda ash trend is volatile, and some companies have intentions to increase prices.

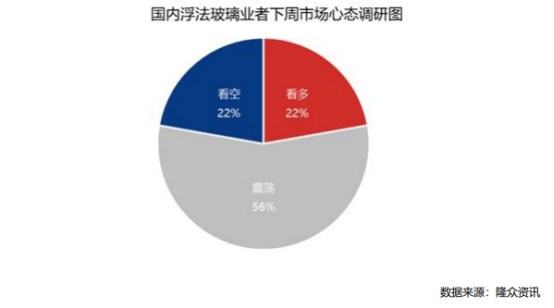

b) Mentality survey

As of April 11, 2024, the results of the survey on the mentality of China's float glass market participants next week (20240412-20240418) show that 56% of the total are optimistic about the market price trend next week, and 56% of the total are bearish. 22%, bullish accounts for 22% of the total.

c) Market forecast: Judging from the market outlook, there is no clear plan to release water or ignite the production line next week, and the supply may continue to maintain a high level. It is understood that demand has relatively improved except for orders for home appliances and home decoration. Stimulated by the increase in corporate growth, the downstream is appropriately replenished this time, and may enter the digestion stage in the future. In the short term, it is expected that the price increase in the float glass spot market next week may be Slow down. (Longzhong Information)