Epoch Master Global Business(Jiangsu)Inc.

Address:Rm.3-93,Tengfei building,No.88 jiangmiao rd., research and innovation park,

Nanjing zone,(jiangsu) pilot free trade zone,China

Tel:13770711448 Email:sales01@epoch-master.com

1. Analysis of market fluctuations of industrial chain products

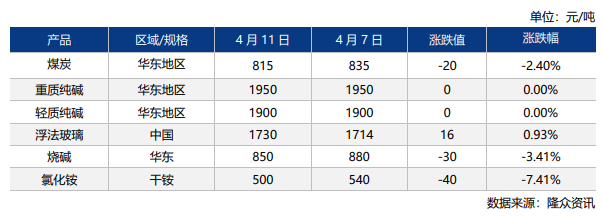

Table 1 Weekly fluctuations in soda ash industry chain products

This week (April 8-April 11, 2024), the prices of industrial chain products fluctuated at low levels. The market price of thermal coal has been reduced to 815 yuan/ton; the mainstream market price of light soda ash in East China is 1,900 yuan/ton, and the mainstream market price of heavy soda ash is 1,950 yuan/ton. The average price of domestic float glass market is 1,730 yuan/ton, up 0.93% month-on-month.

(a) Industry chain profit analysis

Table 2 Theoretical changes in soda ash profits

As of April 11, 2024, the theoretical profit (double tons) of China's combined soda ash was 460.10 yuan/ton, a month-on-month decrease of 54 yuan/ton. The price of coal, the main cost end, fell, while the prices of soda ash and ammonium chloride showed a downward trend, so profits fell. The theoretical profit of China's ammonia-alkali process soda ash is 264.51 yuan/ton, a month-on-month decrease of 71.65 yuan/ton. The price of coke at the main cost end fell, while the price of soda ash fell, so profits fell.

(b) Analysis of industrial chain device operating rate

The output of heavy alkali during the week was 405,800 tons, an increase of 7,500 tons from the previous month; the national float glass output was 1.2238 million tons, a month-on-month decrease of -0.73%; the photovoltaic glass production capacity was 743,700 tons, a month-on-month increase of 1.83%. Supply increased, demand fluctuated slightly, and the gap between heavy alkali supply and demand increased slightly.

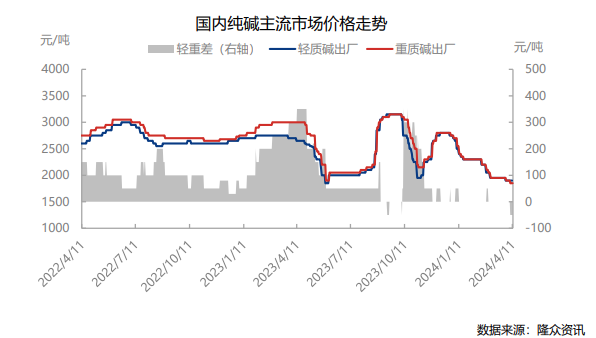

Table 3 Domestic regional price change comparison table

This week, the trend of domestic soda ash is stable but strong, some companies have closed orders, and some companies have raised prices, boosting sentiment. According to Longzhong Information data monitoring, soda ash output during the week was 706,200 tons, an increase of 8,000 tons month-on-month, or 1.15%. The overall operating rate of soda ash was 84.71%, which was 85.05% last week, a month-on-month decrease of 0.34%. The load of individual enterprises has increased, production capacity has been adjusted, and enterprise equipment has been reduced and shut down, so the overall supply has been limited. The inventory of soda ash manufacturers is 912,500 tons, a month-on-month decrease of 4,300 tons, or 0.47%. The order waiting list for soda ash companies has increased to 14 days, the company is receiving better new orders, and the transactions are improving. It is understood that social inventories are increasing in a narrow range with small fluctuations. On the supply side, the soda ash reduction equipment may face recovery next week. Only some equipment is expected to be overhauled. The overall supply is increasing. The operating rate is expected to be around 88% next week, with an output of 730,000 tons. The spot price fluctuated slightly, with transaction orders being the main focus. On the demand side, downstream demand performance improved, and inquiries and transactions increased. The downstream start-up fluctuated slightly. During the week, the daily melting volume of float method was 174,400 tons, a decrease of 0.85% from the previous month. The daily melting volume of photovoltaic was 106,200 tons, which was the same as the previous month. The float and photovoltaic production lines are expected to be stable next week, and two photovoltaic production lines are scheduled to be ignited near the weekend, totaling 2,100 tons. To sum up, the short-term soda ash trend is volatile, and some companies have intentions to increase prices.(Longzhong Information)