Epoch Master Global Business(Jiangsu)Inc.

Address:Rm.3-93,Tengfei building,No.88 jiangmiao rd., research and innovation park,

Nanjing zone,(jiangsu) pilot free trade zone,China

Tel:13770711448 Email:sales01@epoch-master.com

In the first half of the domestic downstream demand performance flat tablet alkali prices weakened

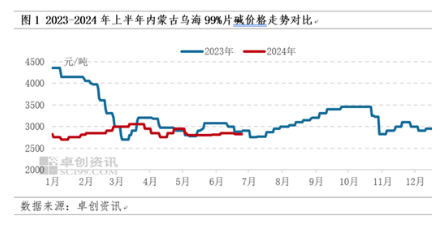

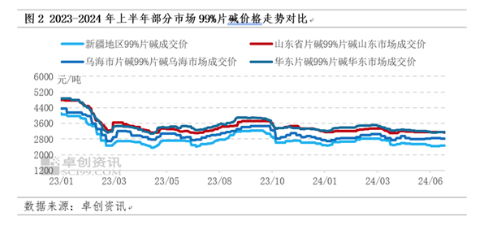

In the first half of the domestic alkali market prices are weak, its basic meet us in the 2023-2024 China caustic soda market annual report on 2024 alkali price relatively weak forecast, alkali price weaker mainly because the downstream demand is limited, insufficient support, although periodic supply reduced by maintenance factors, but the contradiction between supply and demand is still obvious. Taking Wuhai City, Inner Mongolia as an example, the actual value of the average monthly price in the first half of 2024 is in line with the expectation that the mainstream range of the average monthly average price in the annual report is 2700-3055 yuan / ton. In the first half of 2024, the average market price of 99% alkali in Inner Mongolia was 2859.67 yuan / ton, down 12.99% compared with 3286.43 yuan / ton in the same period last year. The average price on June 26 was 2800 yuan / ton, down 0.88% compared with the price of 2825 yuan / ton at the beginning of the year.

From January to March, the price center of gravity moved upward, in line with expectations. From mid-January to February, the plant failure overhaul or the load reduction of the natural gas supply, the production of the factory during the period of the factory price moved slightly upward. But in the second quarter, prices fell first and then rose higher than expected, Main reasons: relatively weak downstream demand in April-May, Despite the decrease in the supply, But relative to the downstream demand performance is more sufficient, In April, Shaanxi Jintai added 300,000 tons of liquid alkali production capacity put into production, and Xinjiang Hesheng Silicon Industry has 100,000 tons of new chip alkali production capacity put into production, Except for partial self-use, There is still a portion of the takeout volume, Bring a certain impact on the alkali pattern of northwest China, Bring some negative news to the price, June forecast due to the downstream demand season, Prices are down, But the actual performance showed a slight increase, Is boosted by some chlor-alkali enterprises maintenance, parking and other factors, And April-May price weak downward, Some downstream enterprises and traders began to enter the market to receive goods, Demand phase improved, Lead to a small pull up of the manufacturers.

The operation logic of the weak operation: oversupply between the two sides of the fierce game, the price pressure down

In the first half of the year, the overall performance of the domestic chip alkali market price is not as good as in previous years, and the price is weak. According to Zhuochuang Information, the main reason is that the supply and demand fundamentals of the domestic caustic soda market are constantly changing. In 2024, the supply side of the domestic liquid alkali and chip alkali market has new production capacity, but the demand follow-up is relatively slow, and the downstream demand is not as expected in some times, which brings a certain drag on the price of chip alkali.

The overall supply is relatively sufficient, bad for the market, but the stage is affected by troubleshooting, to boost the price

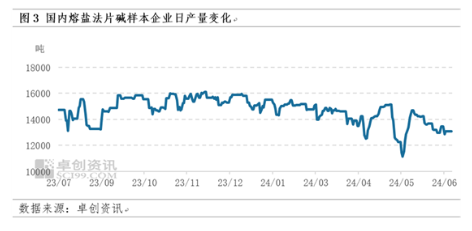

In May 2024, Xinjiang Hesheng Silicon Industry put 100,000 tons of new alkali production capacity into production, and in terms of liquid alkali, Shaanxi Jintai put 300,000 tons of new production capacity into production, which has a certain impact on the northwest alkali market. From the sample enterprise alkali production, January 472200 tons, February 435800 tons, March 453600 tons, April 415500 tons, May 424800 tons, June 407400 tons, although production periodic decrease, but the social inventory is relatively flat downstream demand, slow, even in April, may individual time, domestic individual warehouse warehouse, overall supply enough match downstream demand, present oversupply, so the alkali price overall weak operation.

In the early part of January, The tablet-alkali factory production is relatively normal, Supply is relatively adequate, While the demand is relatively flat, alkali transaction price center of gravity down; From mid-January to February, Plant plant plant plant maintenance, Or due to the load reduction of the tablet alkali plant due to the shortage of natural gas supply, Superadjust the production of some factories before and after the Spring Festival holiday, resulting in a phased reduction in supply, Prices are on the upside; In March, downstream enterprises gradually resumed work and production, Increasing demand for tablet alkali, At the same time, the chip alkali enterprise maintenance is less, alkali production increased; Downstream demand was relatively light in April-May, Poor profitability of chip-alkali enterprises, Carry out the device maintenance in advance, Although the yield is reduced, But after being dragged down by downstream demand, Superlay liquid alkali, chip alkali has new capacity put into production, Price center of gravity moved down; In June, there are still some enterprises' alkali device maintenance or stop or reduce production due to force majeure factors, More loss of chip alkali maintenance, Boost the chip alkali market.

Limited demand growth and weakness in most sectors downstream

Although the production capacity of the main downstream alumina industry of caustic soda has expanded in the first half of this year compared with the first half of last year, the operation rate of alumina was low due to the tight supply of bauxite. The operation rate of alumina in the first half of this year was 72.77%, 0.86 percentage points lower than the average operation rate of bauxite in the first half of 73.63% of last year, and the increment of caustic soda consumption is limited. In addition, the output of viscose fiber industry increased compared with last year, and the cumulative output from January to June was about 2.093 million tons, an increase of 7.29% compared with 1.951 million tons in the first half of last year, and the consumption of caustic soda also increased slightly. The production of pulp and chemical industry is relatively stable, and the consumption of caustic soda changes little; the pesticide industry makes a general profit in the first half of the year, but the starting load rate of the industry is ok, and the consumption of caustic soda increases slightly. On the whole, the consumption of caustic soda increased in the first half of 2024, but the demand increment is not as good as the supply increment, and the supporting effect of the alkali market is not strong.

In addition, the export market performance, exports decreased, according to the General Administration of Customs of the People's Republic of China, 1-5 alkali exports 198400 tons, 1-may last year exports of 265800 tons by 25.36%, low export prices this year, part of the time export without arbitrage space, so exports to domestic without alkali market.

The phased logistics transportation is blocked, but the market supply is relatively sufficient, and the impact on the price of alkali is limited

Before and after the Spring Festival holiday, the efficiency of automobile transportation is not high, and some manufacturers general delivery efficiency, resulting in local arrival; with the end of the Spring Festival holiday, logistics in Inner Mongolia, Ningxia, Shaanxi, Shandong and other affected weather, logistics is blocked, after the Lantern Festival holiday, with the warm weather, logistics transportation gradually return to normal; in May, Xinjiang, Wuhai area due to strict dangerous goods transportation inspection, logistics transportation slightly poor, into the June, fruits and vegetables in Xinjiang occupy certain transportation resources, superimposed freight rise, certain support to the market price of alkali. Although the phased logistics transportation efficiency is not high, the market supply is relatively sufficient, so the impact on the transaction price of the alkali market is relatively limited.

Caustic soda (liquid alkali) second half of the forecast: supply and demand contradiction is still difficult to alleviate the price is expected to still weak operation

For the overall price trend of alkali in the second half of the year, from the supply side, in the second half of 2024, Lanzhou Hewei Environmental protection of 75,000 tons and Shaanxi Beiyuan 400,000 tons of alkali will be put into production, and the supply of alkali will still increase, which will bring a certain drag on the spot price of alkali. From the first half of the base of the market performance, alkali supply is sufficient, so the second half of the supply side still need to pay close attention to the routine maintenance of more, in addition, the State Council issued the 2024-2025 energy saving and carbon reduction action plan, whether the start of chlor-alkali industry influence, and conduction alkali device construction situation need to pay close attention to.

From the demand side, according to zhuo gen information, the largest downstream alumina industry in the second half of the new production, new volume is expected to about 5 million-6 million tons, expected for caustic soda demand increment is probably in 600000-7500 00 tons, superposition of the current subject to bauxite restriction construction of alumina factory smoothly put into production, in the second half of the alumina industry demand for caustic soda increment is expected to have a total of 850000-1 million tons.

However, in May 2024, the State Council issued the Action Plan for Energy Conservation and Carbon Reduction in 2024-2025, which requires optimizing the layout of non-ferrous metals: strictly implement the replacement of electrolytic aluminum capacity and strictly control the new smelting capacity of alumina; in addition, the ceiling effect of downstream electrolytic aluminum capacity restricts the release of alumina capacity and output to some extent, so the capacity of alumina to smooth production still needs to be closely followed.

In addition, some new capacity in the paper (pulp) industry but still uncertainty, and viscose fiber, chemical industry, printing and dyeing and other traditional alkali consumption industry is scarce, limited expansion space, difficult to affect the expansion in recent years, further expansion pace has slowed down, the overall boost to the wave alkali market is relatively weakened compared with previous years. Therefore, from the perspective of the fundamental game of supply and demand, the overall supply increment of caustic soda is greater than the demand increment, and the contradiction between supply and demand is still difficult to alleviate, which will still bring a sustained negative impact on the price.

From the perspective of liquid alkali market, in the second half of the year, the wave alkali market is still more by the supply increment than the demand increment, and the overall price is still weak, so it is difficult to support for the liquid alkali to boost the alkali market.

In general, in the second half of the year in the period without maintenance, the supply of alkali is sufficient, in the downstream in addition to alumina, non-aluminum downstream is difficult to have an obvious bright spot, the overall alkali market is still difficult to significantly improve, the price of alkali is more narrow concussion. Taking Wuhai region of Inner Mongolia as an example, the local mainstream factory price of 99% of alkali may fluctuate in the range of 2650-2900 yuan / ton. If the energy saving and carbon reduction have a greater impact on the alkali device or the maintenance is relatively concentrated, the price is expected to rise by 100-200 yuan / ton on the basis of the above base.