Epoch Master Global Business(Jiangsu)Inc.

Address:Rm.3-93,Tengfei building,No.88 jiangmiao rd., research and innovation park,

Nanjing zone,(jiangsu) pilot free trade zone,China

Tel:13770711448 Email:sales01@epoch-master.com

|

Catalogue: One: the cost factor support, asphalt prices rise Two: capacity utilization fell 1.1%, commercial inventory slightly to the warehouse Three: demand performance has increased and decreased, and logistics activity remains low Four: supply and demand relations ease, prices still have upward space |

As of July 4,2024, the average price of domestic asphalt is 3675 yuan / ton, which is increased by 24 yuan / ton compared with last week. This week, the price of asphalt is stable, and the strong and weak differentiation between the north and south has changed.

In the week, the seven regions, except for the southwest region prices are stable, the other six regions have risen to varying degrees. Crude oil strengthened in the week, cost support is relatively strong, some refinery prices continued to push up. However, with the gradual shift of the main rain belt in the south, the rainfall in the northern region has increased, and the market needs to be slightly blocked. In addition, some refineries switch to asphalt, and the competition of brand resources increases, pushing up the momentum to slow down. With the gradual emergence of the weather in southern China, the recovery of market demand and some individual production production, the supply in the region remained low, and some shipping low-price resources pushed up slightly, and the market trading atmosphere was driven by the buying sentiment. Overall, the domestic asphalt spot price is stable in the strong operation.

2. Capacity utilization fell 1.1%, with commercial inventories slightly reduced

1. Supply side

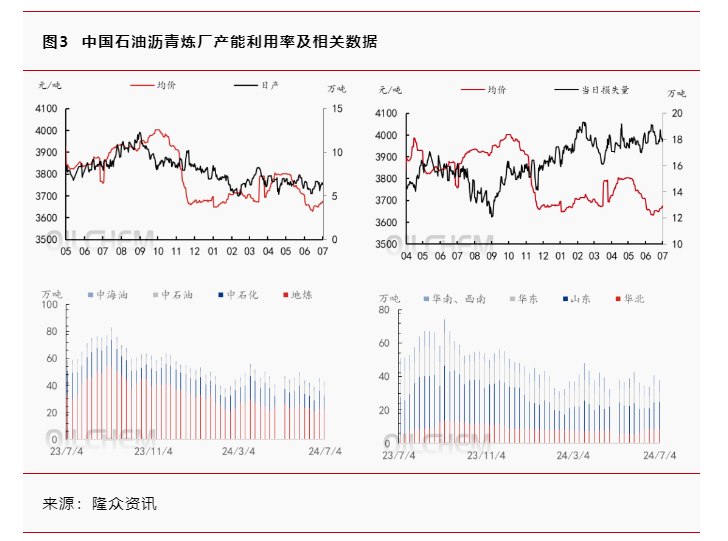

On the supply side, this week (20240627-0703), the capacity utilization rate of Chinese asphalt refinery was 24.6%, down 1.1 percentage points from the previous month, and the weekly output of asphalt was 430,000 tons, down 5.2% from the previous month. Mainly Qilu Petrochemical and Ningbo Keyuan both resumed asphalt production, but Jiangsu Xinhai and Jinling Petrochemical stopped asphalt production, with a total capacity loss of 3.4 million tons / year, and the overall capacity utilization rate decreased. It is expected that the capacity utilization rate of China's asphalt refinery will increase by 2.1 percentage points to 26.7% next week, mainly due to the resumption of production of Jinling Petrochemical next week and the normal production of Jiangsu Xinhai and Ningbo Keyuan, which leads to the increase of capacity utilization rate. However, year-on-year, the capacity utilization rate of asphalt refinery is at the low level in nearly five years, and the planned output of the main refinery decreases in the month drops, which supports the price.

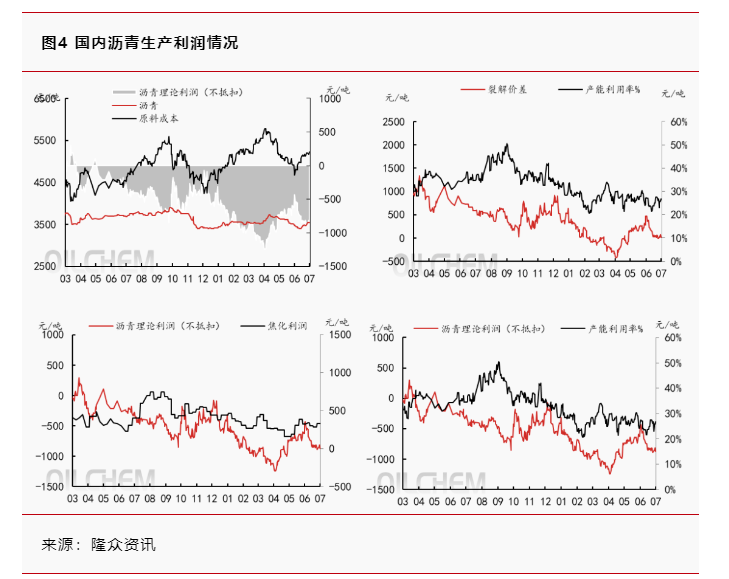

This week, according to the current raw material price, the average weekly profit of asphalt production is-852.9 yuan / ton, 20.9 yuan / ton less than the previous month. The weekly average price of asphalt in Shandong is 3520 yuan / ton, up 41 yuan / ton compared with last week; the weekly average price of raw materials is 5183 yuan / ton, up 44 yuan / ton compared with last week; the average weekly average price of diesel in Shandong is 7242 yuan / ton, down 14 yuan / ton compared with last week. Within the week, both raw materials and asphalt increased, but the price of gasoline and diesel was relatively weak, and the theoretical profit of asphalt narrowed and was in a loss state.

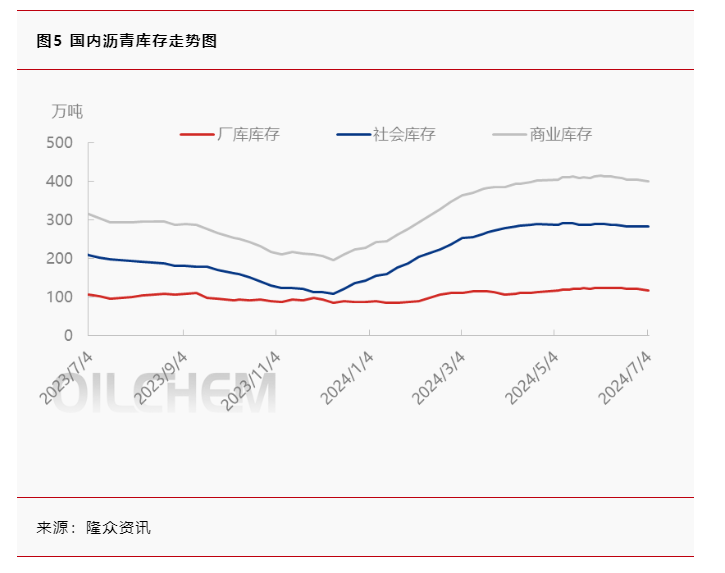

In terms of inventory, as of July 4,2024, the inventory of 54 asphalt sample plants in China totaled 1.164 million tons, down 4.4% compared with last Thursday (June 27). In this period, the domestic asphalt factory warehouse inventory is obvious, among which there are more warehouses in East China, mainly due to the conversion of some refineries, the overall supply decline, and the removal of ship transfer, the factory warehouse inventory is obvious. As of July 4,2024, the inventory of 104 domestic asphalt social warehouses totaled 2.84 million tons, an increase of 0.4% compared with last Thursday (June 27). In the statistical cycle, the domestic social inventory is slightly accumulated, and most areas in China appear, among which the accumulation in central China is more obvious, mainly due to the centralized storage of refinery shipments and cargo, and a small amount of warehouse resources are moved to the social inventory, driving the social inventory. On the whole, the commercial inventory is reduced, and the relationship between supply and demand is alleviated, which is good for the mentality of the asphalt industry.

3. Demand performance has increased and decreased, and logistics activity remains low

1. Logistics activity

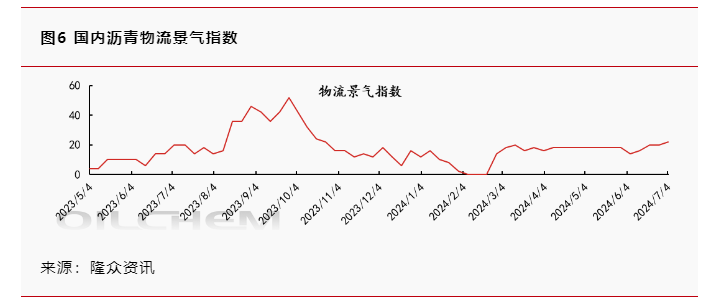

This week, the sample asphalt logistics climate index of enterprises was 22, an increase of 2 from the previous month. Within the week, the logistics activity was in a low state, and the demand in northwest Xinjiang improved, driving the trading atmosphere of the industry.

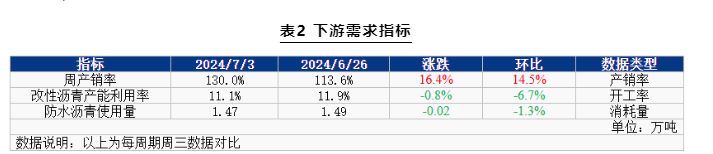

In the downstream aspect, the sample shipments of 54 domestic asphalt manufacturers totaled 409,000 tons, up 8.2% from the previous month. In terms of shipments, 6 regions increased and 1 region decreased, among which the shipments of Shandong, East China and South China increased relatively more. Shandong is the main refinery at the end of the month, and the shipments increased after Shandong Xingxing; East China is the ship shipment of the main refinery, driving the shipments increase; South China is the main refinery of CNPC, and the weather improved slightly and the shipments increased recently. The capacity utilization rate of modified asphalt in 69 sample enterprises of domestic modified asphalt was 11.1%, a decrease of 0.8% from the previous month. During the week, the rainfall weather was concentrated, the downstream construction was blocked, and the demand for modified asphalt was weakened to inhibit the overall processing enthusiasm. Within the week, the building waterproof market changed little, and the amount of asphalt of the sample enterprises was 14,700 tons, down 1.3% from the previous month.

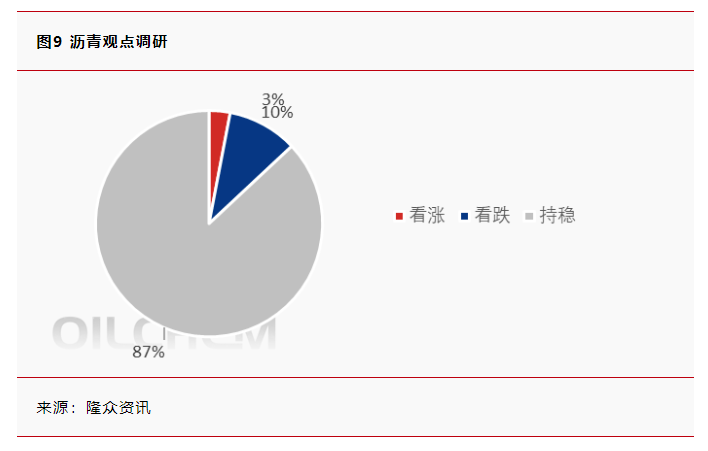

In this cycle, Longzhong Information investigated 68 domestic enterprises, combined with the supply and demand of the domestic asphalt market, the bullish accounted for 3% of the total, up 2 percentage points; the shock consolidation 87% of the total, up 9 percentage points; the bearish 10% of the total, down 11 percentage points.

Conclusion (short-term): international crude oil strong operation, asphalt cost support, superposition peak season demand expectations, market arbitrage speculative demand is fair, but the overall market strength, the northern rainfall weather influence superposition some refinery resources competition, asphalt spot market weak, overall transaction slowdown, considering the middle contract impact, the spot resources pressure remains; southern region, with the weather, the market just need or recover, factory inventory pressure is limited, the basic for cargo float or social library resources, but the supply or increase, individual main refinery is expected to resume production. In the short term, asphalt spot is expected to appear differentiation trend, the northern market under small pressure, the southern low resources support.

Conclusion (medium and long term): July is the rainy season and high temperature season, rainfall weather is still the dominant negative factor for the market, and the capital problem restricts the release of demand, the actual market demand is difficult to be optimistic. On the supply side, production scheduling in July was still lower than that compared to the same period in previous years. On the whole, the supply and demand of asphalt market are weak, the high commercial inventory is difficult to improve in the short term, and the market is mainly volatile. But we still need to be wary of the cost side of the price to support the boost. It is expected that the relationship between supply and demand has improved in July, and the prices are mainly strong at the cost end, and some low-end prices have room to increase.

Core concerns:

1. Many places are affected by heavy rainfall weather, and the release of downstream terminal demand is blocked.

2. the cost support is obvious, and the asphalt supply is low.

3. The contradiction between supply and demand eases, and the commercial inventory is reduced.

(Longzhong Information)