Epoch Master Global Business(Jiangsu)Inc.

Address:Rm.3-93,Tengfei building,No.88 jiangmiao rd., research and innovation park,

Nanjing zone,(jiangsu) pilot free trade zone,China

Tel:13770711448 Email:sales01@epoch-master.com

[Introduction] In the past decade, China's EVA supply has been sailing all the way, and many changes have taken place in the industry: the continuous expansion of production capacity, the continuous improvement of self-sufficiency rate, the transformation of supply pattern from concentration to diffusion, and the nature of enterprises from state-owned to private enterprises. In the future, with the continued expansion of EVA petrochemical industry, the industry competition intensifies, and challenges and opportunities coexist. EVA supply changes in the country in the last decade:

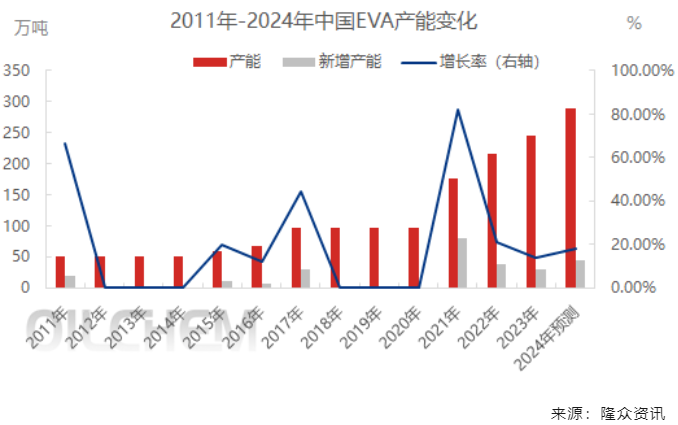

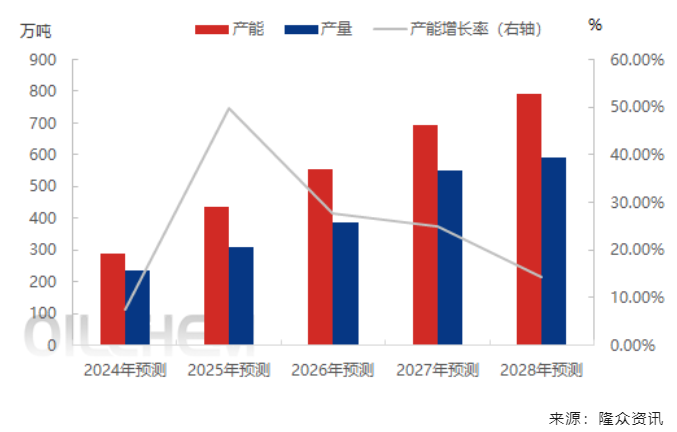

China's EVA industry started late, and the 40,000 tons / year EVA device put into production in February 1995 is the first set of equipment in China. Until the end of 2005, the LDPE production plant with an EVA capacity of 200,000 tons / a year of 200,000 was put into production. After 200,000 tons was put into production in 2011, the domestic EVA capacity reached 500,000 tons / year, and its capacity level was maintained until 2014. From 2015 to 2017, it entered a new round of production period, during which a total of 472,000 tons of EVA production capacity was increased. By 2017, China's EVA annual production capacity has reached 972,000 tons, with an average three-year growth rate of 25.55%. There was no new domestic EVA capacity in 2018-2020. With the centralized production of China's refining and chemical capacity, the domestic EVA industry has entered a stage of large-scale expansion since 2021. And the new capacity and expansion from 2021 to 2023 totaled 1.478 million tons, with an increase of 152%. From 2011 to 2023, due to the impact of device construction and production cycle and downstream demand, the capacity of China's EVA industry expanded intermittently, and its expansion cycle basically maintained at about 6 years. From 2011 to 2015, and from 2020 to 2024, respectively, the growth rate of production capacity was first slow and then fast. As can be seen from the data below the figure: since 2015, the production capacity of China's EVA industry has been in a period of rapid growth, with the growth rate of production capacity being 12% -82%. According to longzhong statistics, the new domestic production capacity in 2024, is expected to be 450,000 tons, namely the 200,000 tons of Ningxia Baofeng and Jiangsu Hongjing 200,000 tons, which will be put into production in the fourth quarter. The annual production capacity may reach 2.9 million tons in 2024.

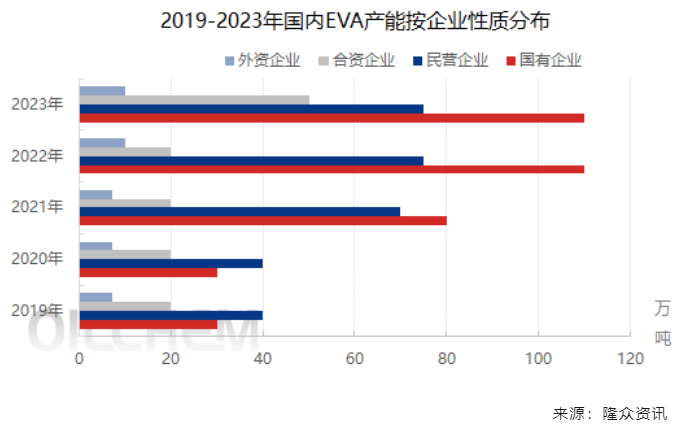

In 2019-2023 domestic EVA production enterprise type distribution, still dominated by state-owned enterprises, private enterprises occupy the second after state-owned enterprises, private enterprises since 2021, and continued to grow in 2023,2023, joint venture enterprises accounted for not ascend, foreign capital enterprises accounted for the smallest. The main reason for this distribution of enterprises is that although EVA technology is relatively mature, a single set of production capacity investment is relatively high, so the nature of the overall industry is still dominated by state-owned, private enterprises and joint ventures with scale or strength. In the next two years, Zhejiang Petrochemical and Jiangsu Sierbang Petrochemical, which have two existing EVA enterprises, will continue to expand their production capacity of 500,000-700,000 tons. After the production, the scale proportion of enterprises will be greatly increased, which will significantly distance from the capacity of other enterprises, and the concentration of industry capacity will also be significantly improved. The increase of capacity concentration means that the decision-making ability of EVA market is improved, and the decision-making of top enterprises and the adjustment of price direction will have a certain impact on the EVA market.

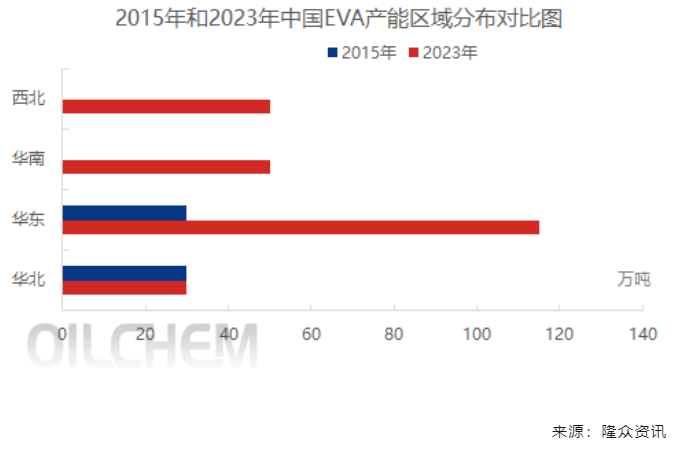

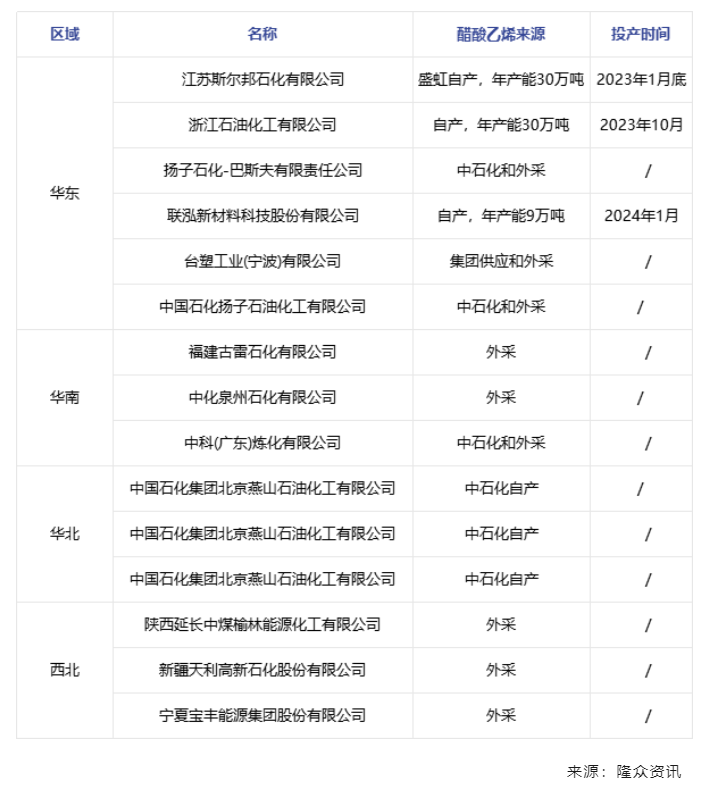

From the regional point of view, the regional distribution of domestic EVA production capacity in 2023 is still relatively concentrated, mainly concentrated in east China, South China, North China and northwest China. According to detailed analysis, East China is the most concentrated, with a total EVA capacity of 1.15 million tons, accounting for 54%; followed by South China with capacity of 500,000 tons, accounting for 21%, the third is northwest with capacity of 500,000 tons, accounting for 20%; the fourth is North China with capacity of 300,000 tons, accounting for 12%. Compared with 2015, south China and northwest China have filled the gap of EVA capacity, while the distribution of capacity in East China continues to expand, while the capacity in North China remains at the original level. In terms of provincial distribution, China's top three provinces of EVA capacity are in Jiangsu, Zhejiang and Fujian provinces. According to Longzhong, the new production of EVA in China will still be mainly in Jiangsu, Zhejiang, Fujian, Shandong, and expand to Guangxi, Jilin, Henan and other places, which will further improve the current situation of uneven regional distribution.

In recent years, with the decline of EVA price from the peak and the return of industry profits, the impact of cost logic will be an important factor for enterprises to consider the production planning. For EVA enterprises, supporting the upstream vinyl acetate has become the priority cost reduction planning of each petrochemical industry. According to the statistics of Longzhong Information, before 2023, Chinese EVA enterprises with upstream vinyl acetate only Sinopec system Yanshan Petrochemical; and as of May 2024, supporting upstream ethylene acetate EVA enterprises increased 3, Zhejiang Petrochemical, Jiangsu Sierbang and Lianhong Xinke three private enterprises. EVA production enterprises supporting upstream vinyl acetate process is accelerated, the downstream involved fields to produce photovoltaic film, foam shoe materials, cable, hot melt glue and agricultural film products enterprises, its industry is numerous and mature, the possibility of downward extension is not large.

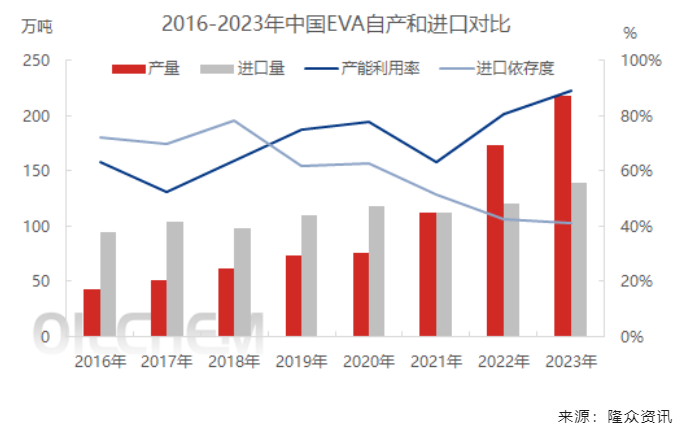

With the continuous expansion of domestic EVA production capacity, the domestic EVA production has increased significantly, and the import dependence continues to decline. As can be seen from the figure below, the annual output of domestic EVA has increased from 330,000 tons in 2016, less than half of the import level, to 2.18 million tons in 2023, and the annual output has increased nearly 7 times. The compound growth rate of output from 2019-2023 reached 31.46%, the capacity utilization rate maintained at a high level of 75% -89%, and the import dependence has decreased from the high of 78.22% in 2018 to 41.35% in 2023. China's EVA self-sufficiency has increased significantly, and its import dependence has continued to decline.

According to incomplete statistics of Longzhong Information, starting from 2025, a new round of EVA centralized production cycle will start in China. From 2025 to 2026,3 million tons of EVA units will be put into production, and the domestic EVA production capacity may reach 8 million tons by 2030. China's EVA industry production speed and industry economic environment and profitability, industry under the background of high profit, EVA enterprise new production plan increased, but the device production considerations, from the device to implement about 3 to 4 years, so the future 2025-2028 continued intensive production and 2020 EVA market profit space rose sharply. In 2024, the profit level of EVA industry will gradually return to the cost, and the new round of EVA production in the next five years may make the domestic EVA industry undergo tremendous changes, the market competition intensifies, and the healthy development of the industry has a long way to go.

(Longzhong Information)