Epoch Master Global Business(Jiangsu)Inc.

Address:Rm.3-93,Tengfei building,No.88 jiangmiao rd., research and innovation park,

Nanjing zone,(jiangsu) pilot free trade zone,China

Tel:13770711448 Email:sales01@epoch-master.com

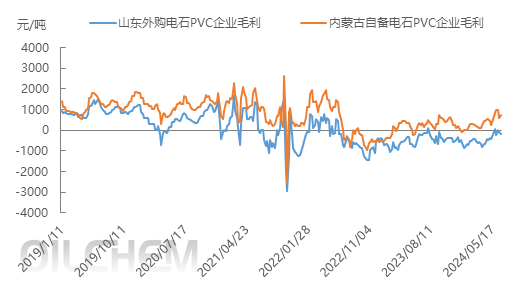

Guide language: to outsourcing calcium carbide PVC enterprise, for example, through nearly five years of PVC enterprise margin trend, since 2019, PVC industry profit space after increased decrease trend, since 2022, outsourcing calcium carbide PVC has been in the red for two consecutive years, enterprise production pressure increases, continue to benefit space is limited, the PVC at the bottom of the price support. In May 2024, under the stimulus of spring inspection and macro favorable policies, PVC rose, and the gross profit was repaired to some extent.

Two consecutive years of continuous losses, PVC price bottom deposit support

Purchased calcium carbide method PVC gross margin

Figure 1 The gross profit trend of PVC enterprises by calcium carbide method

In 2019-2020, PVC will be basically profitable, Most of the time in 2019, PVC Maintain the range of concussion trend, Overall operation is stable, No big ups and downs have occurred, The average annual gross profit of Shandong outsourcing calcium carbide PVC enterprises is 510-948 yuan / ton; In 2021, PVC experienced a sharp rise and fall, PVC Although prices are constantly hitting new highs, But the same price of calcium carbide as raw material also rose to the high level of more than 8000 yuan / ton, The PVC enterprise that has purchased calcium carbide is still in the loss for part of the time, Among them, in October 2021, PVC enterprises all losses, Even once reached a loss of-2,000 yuan / ton, That has pulled down the level of profits for the full year, In 2021, the average annual gross profit of PVC enterprises is-36 yuan / ton. In 2020, the new production capacity will be gradually implemented, while the recovery of terminal demand will be slow, the contradiction between supply and demand of PVC industry will increase, and the gross profit will be compressed. From 2022 to 2023, the gross profit of PVC enterprises in Shandong will be-305 yuan / ton and-499 yuan / ton respectively. In 2024, the capacity expansion of PVC industry is still under way, while the downstream demand is slowing down due to the decline of real estate construction, and the growth rate of demand is less than that of supply. The gross profit of purchased calcium carbide PVC has been negative, limiting the decline of PVC price.

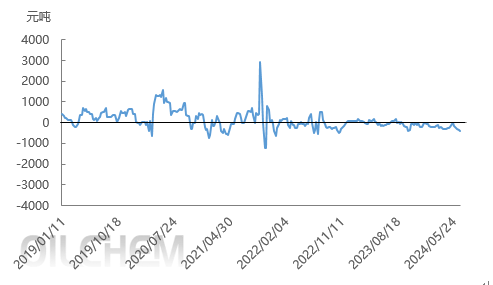

Purchased vinyl chloride PVC gross margin

Figure 2 Gross profit trend of PVC enterprises

The main factors affecting the gross profit of ethylene method PVC enterprises are the change of the sales price of crude oil, ethylene, ethylene chloride and PVC. The following analysis takes the gross profit of outsourced ethylene chloride PVC enterprises as an example. According to the above figure, the gross profit of ethylene enterprises in 2019-2024 shows a trend of rising first and then falling. From the time span of profit, the overall profit of ethylene enterprises is better than that of outsourced calcium carbide enterprises. In October 2021, the gross profit of ethylene enterprises fluctuated greatly, and experienced the roller coaster trend of the highest 2916 yuan / ton to the lowest-1244 yuan / ton in the profit month. Mainly because the PVC price rose sharply. When the PVC price started falling, the price of vinyl chloride was still high, resulting in a large loss of gross profit of enterprises. In 2024, most of the time, the gross profit of ethylene PVC enterprises is negative, and the profit of PVC industry is continuously narrowed, and the space for enterprises to be limited.

Future expectations:Given the possibility of early trading in the fall season, the market is expected to rebound in mid-July.

Raw material calcium carbide end:In general, the change of supply and demand is still the key to affect the calcium carbide market. Next week, with the arrival of downstream PVC centralized maintenance, the demand is less and the increase of concentrated sales of supporting calcium carbide will increase the impact on the calcium carbide market. Under this influence, the market bearish sentiment released in advance, trade trading cautious, at the same time with the reduction of raw material orchid carbon price, the cost end support weakened, the downward space increased, July calcium carbide prices may fall below the lowest point in the first half of the year. Cost end to PVC support weakened.

Gross profit:In July, driven by maintenance and macro expectation preference, PVC price is expected to rebound, while the price of calcium carbide fell, the cost is expected to decline, July may show PVC price and gross profit two-way increase.

Overall, PVC prices in July or rose after consolidation. From the perspective of supply and demand, PVC maintenance in July is relatively concentrated, enterprises may decline, the market supply is expected to weaken, but at the same time, the social inventory pressure is not reduced, the cost support is weak, the demand is gradually entering the traditional off-season, and the weak situation of supply and demand will continue. However, considering the maintenance and macro expectations, SG-5 in East China is expected to be in the range of 5700-5980 yuan / ton in July.(Longzhong Information)